14 Which of the Following Best Describes Term Life Insurance

A A mutual fund and an endowment policy b A term insurance policy and a whole life policy c A modified endowment policy and an annual term insurance policy d A flexible premium deposit fund and a monthly renewable term insurance policy. Which of the following terms best describes a life insurance policy that provides a straight 100000 of coverage for a period of five years.

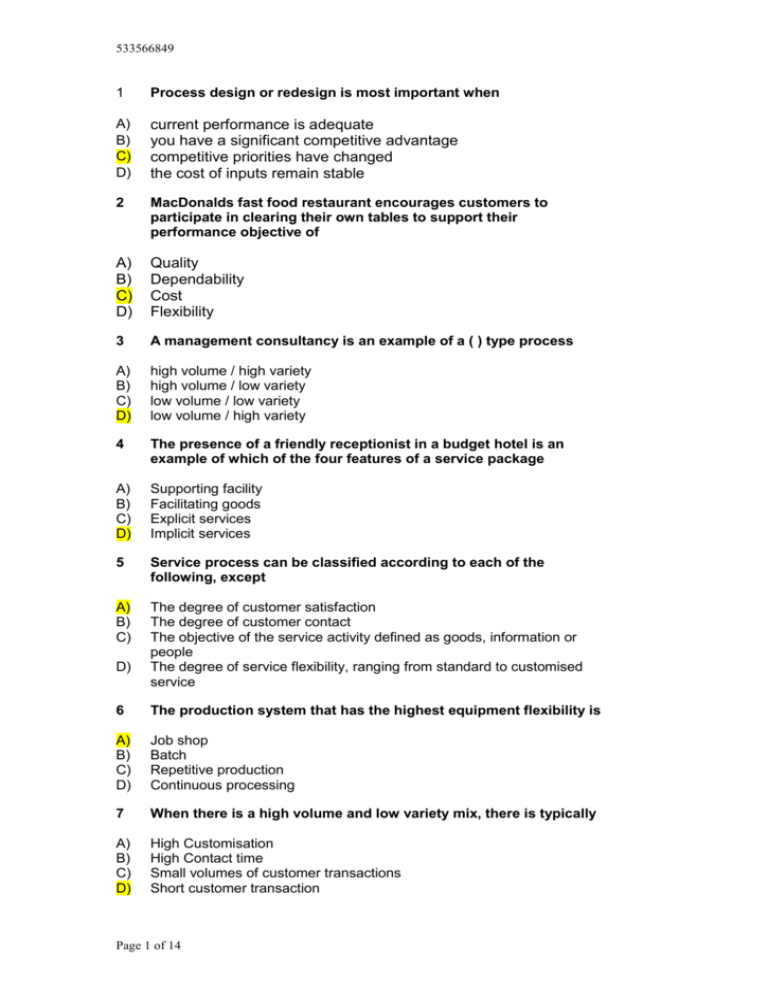

Answers To Multi Choice Session 2 Product Process Layout Design

And these costs can be from 100 to several tens or.

. Neither the premium nor the death benefit is affected by the insureds age B. -best describes term life insurance. Life insurance can be Term or Whole Life.

The insured can borrow or collect the cash value of the policy. Term insurance is paid over a short period of time such as 1 time a year for a short period of. Term life insurance allows you to save money and place it into other accounts that will grow.

Buena Terra Corporation is reviewing its capital budget for the upcoming year. The insured can borrow or collect the cash value of the policy. Neither the premium nor the death benefit is affected by the insureds age.

The insured pays the premium until his or her death. The insured pays a premium for a specified number of years. This means that youll slowly.

A universal life insurance policy ULI is considered to be. Which of the following best describes term life insurance. An agent explains the details of a life insurance policy to a client.

Probability of dying increasing as you grow older. The insured pays the premium until his or her death. Added 4142012 54814 PM.

Is a tool to reduce your risks. The choice that best describes term life insurance is. Depending on the chosen program you can partially or completely protect yourself from unforeseen expenses.

Depending on the chosen program you can partially or completely protect yourself from unforeseen expenses. The insured pays the premium until his or her death. The insured can borrow or collect the cash value of the policy.

A Neither the premium nor the death benefit is affected by the insureds age. The insured pays a premium for a specified number of years. 1 day agoWhich of the following best describes term life insurance.

Log in for more information. The following best describes term life insurance. The companys target capital structure is 60 equity and 40 debt it has 1000000 shares of common.

The agent does not realize however that the state has recently rewritten two of the provisions. Depending on the chosen program you can partially or completely protect yourself from unforeseen expenses. Which of the following best describes term life insurance.

This answer has been confirmed as correct and helpful. The insured is covered during his or her entire lifetime. Dying before financial obligations have been met.

C It is level term insurance. B It provides an annually increasing death benefit. The insured pays a premium for a specified number of years.

Which of the following best describes term life insurance. Which of the following best describes term life insurance. It has paid a 300 dividend per share DPS for the past several years and its shareholders expect the dividend to remain constant for the next several years.

The insured pays a premium for a specified number of years. Which of the following BEST describes a double indemnity provision in travel accident insurance. Which of the following best describes term life insurance is a tool to reduce your risks.

And if the accident insurance event occurs the insurance company will bear all or all of the costs in full or in part. The insured is covered during his or her entire lifetime. Which of the following best describes term life insurance.

Which of the following best describes annually renewable term insurance. 21- Which of the following best describes what life insurance is designed to protect against. The insured can borrow or collect the cash value of the policy.

It should be noted that coverage is also for a specified number of years. Benefits are doubled under certain circumstances stated in the policy b. It is level term insurance D.

The following best describes term life insurance. A type of life insurance that guarantees payment of a stated death benefit if the covered person dies during a specified term. The insured is covered during his or her entire lifetime.

It is level term insurance. See the answer See the answer done loading. The insured pays the premium until his or her death.

Which of the following best describes term life insurance. What best describes this situation. It provides an annually increasing death benefit.

Which of the following best describes annually renewable term insurance is a tool to reduce your risks. As a result the agent inadvertently misrepresents the policy making it more attractive than it really is. The insured pays a premium for a specified number of years.

The insured pays a premium for a specified number of years. The insured is covered during his or her entire lifetime. With answer 4 a whole-life or universal life policy both offer a cash-value savings account that is tax deferred.

Which of the following best describes annually renewable term insurance. And if the accident insurance event occurs the insurance company will bear all or all of the costs in full or in part. It provides an annually increasing death benefit C.

The following best describes term life insurance. And if the accident insurance event occurs the insurance company will bear all or all of the costs in full or in part. If the claim is disputed in court and the insurer loses the face amount will.

A term insurance only B a form of fixed face fixed premium whole life insurance C a whole life policy where the face amount may be changed at any time D providing more flexibility in paying premiums. Which of the following best describes annually renewable term insurance.

No comments for "14 Which of the Following Best Describes Term Life Insurance"

Post a Comment